The 10 Best Financial Habits for Working Professionals

July 25, 2025

Financial well-being starts here

July 25, 2025

You don’t need to win the lottery or launch the next unicorn to make what you earn become your pathway to long-term security. For most working professionals, wealth isn’t about windfalls. It’s about habits. The right financial behaviors, repeated consistently, can turn a solid salary into long-term security, freedom, and real options.

When it comes to money, that steady part is everything. Consistency, automation, and repetition are what quietly build the kind of wealth that supports big milestones like buying a home, raising a family, or retiring without stress.

We’re not here to tell you what you should do with your money. But we are here to say that quiet wealth accumulation is something everyone should feel proud of.

Raises disappear into lifestyle upgrades. Bonuses get spent before they ever build momentum. Savings goals stay vague. Meanwhile, people who actually build wealth play a different game: they focus on education and systems.

They think long-term.

One of the most powerful wealth-generating habits is paying yourself first. Automate 10–20% of your income into savings, investments, or retirement accounts before the rest ever hits your chequing account.

Automation removes decision fatigue and turns compounding into your ally. Financial advisors consistently rank automatic contributions—especially to RRSPs and TFSAs—as one of the highest-impact behaviors for long-term wealth.

Related Reading: Best Budgeting & Personal Finance Apps In Canada For 2025

Surveys show that people with formal financial education are nearly 3× more likely to consistently save and budget. Earning more doesn’t guarantee wealth. Spending less than you earn does.

When promotions or bonuses come in, resist upgrading everything at once. Channel raises toward investments, debt repayment, or emergency savings instead. This habit alone separates people who “look rich” from people who are rich.

“Do not save what is left after spending; instead spend what is left after saving.” — Warren Buffett

Credit card balances and high-interest personal loans quietly erode wealth. Because high interest compounds against you, paying this debt down aggressively is one of the fastest ways to improve your financial position.

Think of debt elimination as a guaranteed return—often far better than most investments.

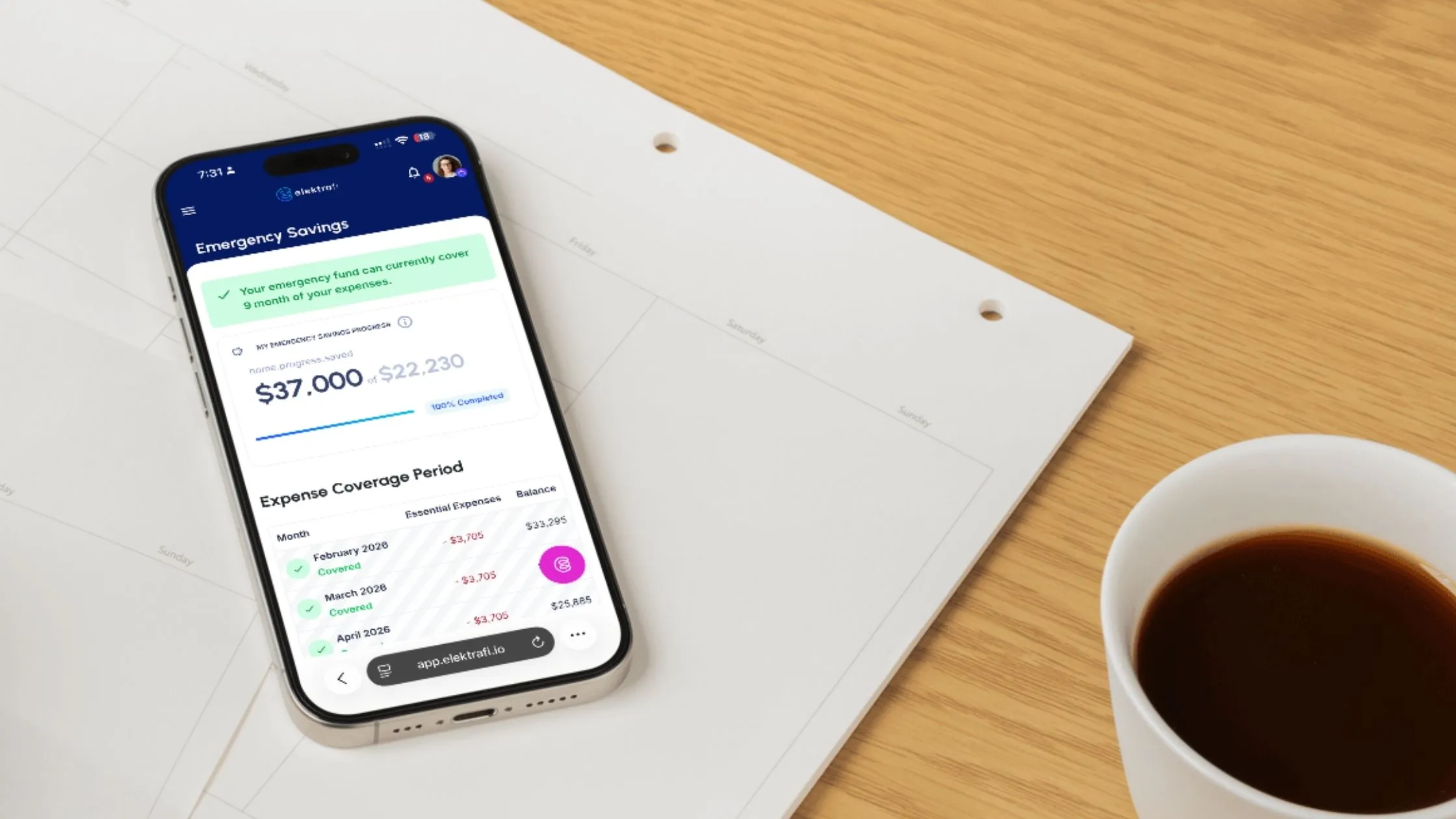

Over 40% of Canadians say they could only cover basic expenses for less than a month if they lost their income. An emergency fund protects you from layoffs, medical bills, and surprise expenses without forcing debt or panic decisions.

While 3–6 months of expenses remains the baseline recommendation, many financial experts now suggest aiming for closer to 6–12 months during periods of economic uncertainty.

If your employer offers RRSP matching, pensions, or employee share plans, not using them is leaving money on the table. Employer matching is literally free compensation.

Yet a surprising number of employees fail to maximize it each year.

Trying to “time the market” rarely beats steady, automated investing. Regular contributions leverage dollar-cost averaging and remove emotion from decisions.

This habit builds wealth quietly and reliably over time—especially when paired with tax-advantaged accounts.

“The individual investor should act consistently as an investor and not as a speculator.” — Benjamin Graham

Even modest side income—freelancing, dividends, consulting, or rental income—adds resilience. Multiple income streams reduce reliance on a single employer and increase long-term optionality.

The global side hustle/gig economy was valued at ~$556.7 billion in 2024 and is projected to grow significantly in the coming decade.

You don’t need to hustle constantly. Small, sustainable efforts compound.

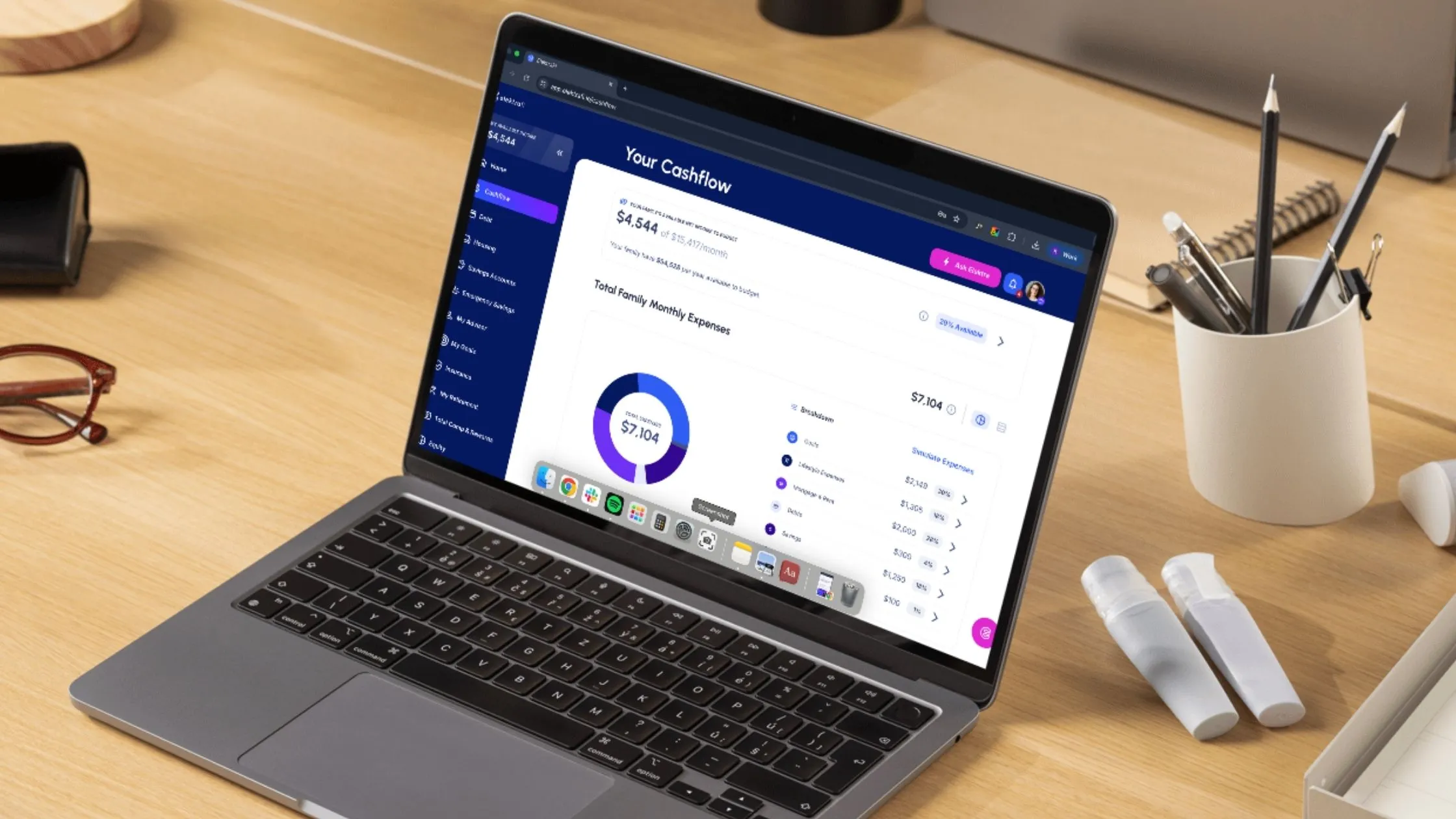

According to the Academy Bank, in 2025, 53.8% of Americans manually track expenses, and 20.9% use budgeting apps (with many using multiple tools to manage money).

Weekly or monthly financial check-ins help uncover cash leaks, unused subscriptions, and misaligned goals. Even one focused “Friday finance hour” per week can dramatically improve awareness and follow-through.

Related Reading: AI Budgeting Tools – How To Use Them to Maximize Your Money

Impulse spending feels good in the moment but slows progress toward bigger goals. Wealth-builders delay gratification and align spending with long-term priorities like retirement, education, or financial independence.

This mindset shift is subtle—but powerful.

“Spending money to show people how much money you have is the fastest way to have less money.”— Morgan Housel

Financial literacy isn’t optional—it’s a compounding advantage. Books, courses, webinars, and peer learning all help you adapt to changing tax rules, markets, and life stages.

Wealth-building habits almost always start with expanding your mindset.

Consider trying out free online financial courses from ElektraFi U.

A reliable income is a great starting point—but habits determine outcomes like long-term financial security.

Wealth isn’t built overnight. It’s built intentionally.

Whether you’re an employee looking to build long-term financial security or an employer aiming to support your team’s financial wellbeing, ElektraFi helps turn good intentions into sustainable habits. With on-demand financial education, smart tools, and unbiased guidance, ElektraFi makes it easier to build wealth slowly—and confidently.

Learn the top 15 employee engagement strategies for 2026, covering wellbeing, flexibility, AI personalization, and retention-focused leadership.

Discover the top AI tools transforming personal finance in 2026, from smart budgeting to AI-powered investing. Leverage AI to reach new financial heights.